Long-term care is an essential consideration for individuals and families in Maryland, especially as healthcare costs continue to rise. Planning ahead can help protect your assets from Medicaid recovery and ensure your estate is preserved for your loved ones. This guide will explain the basics of long-term care planning, how Medicaid recovery works, and why it’s critical to work with an experienced Maryland attorney.

What is Long-Term Care Planning?

The Importance of Long-Term Care

Long-term care involves a range of services designed to help individuals manage daily activities due to chronic illness, disability, or aging. This care can be provided in various settings, including:

- Nursing homes

- Assisted living facilities

- In-home care

- Adult day care centers

- Memory care units for individuals with dementia or Alzheimer’s

- Respite care for caregivers

- Continuing care retirement communities (CCRCs)

- Hospice care for end-of-life support

With the high cost of long-term care in Maryland, many families rely on Medicaid to cover expenses. However, Medicaid eligibility requirements are strict, and the program has a recovery provision that allows the state to recoup costs from the estates of beneficiaries after their passing.

Long-Term Care Planning Goals

Preserve Assets

Long-term care costs can quickly deplete your hard-earned assets, including your home, retirement savings, and other investments. Effective planning helps shield these assets from being used to cover care expenses, allowing you to maintain financial security and leave a legacy for your family. Strategies such as establishing trusts or leveraging life estate deeds can ensure that your property and savings are preserved while still providing for your care needs.

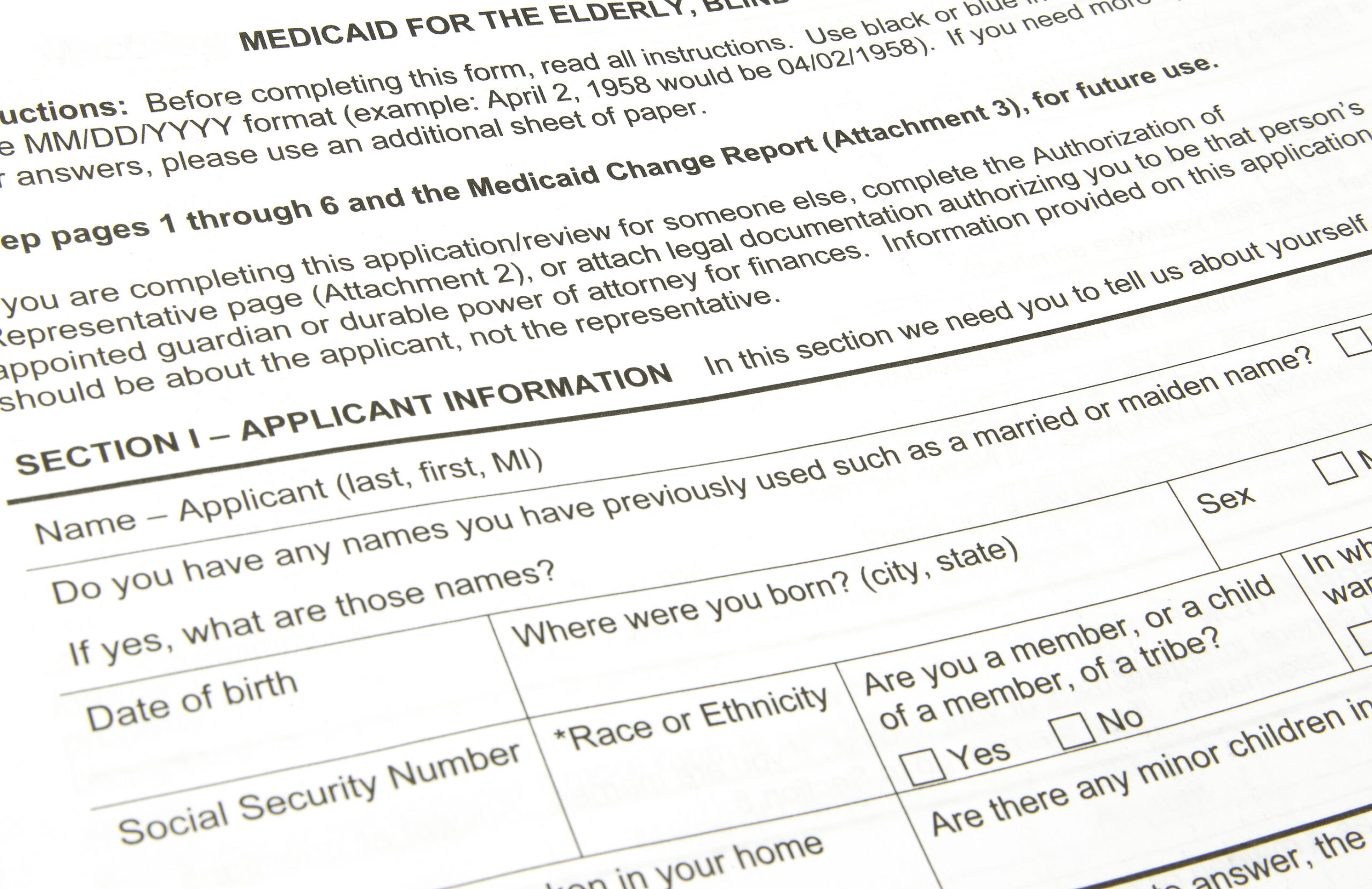

Qualify for Medicaid

Medicaid is a vital resource for covering long-term care expenses, but its strict eligibility requirements can pose challenges for individuals with significant assets. Proper planning involves restructuring your finances to align with these requirements without sacrificing your financial stability. This might include:

- Transferring assets to a Medicaid Asset Protection Trust

- Spending down assets strategically

- Utilizing exemptions that allow you to retain certain resources

Provide for Loved Ones

One of the most important aspects of long-term care planning is ensuring that your loved ones are provided for in the future. Whether it’s passing down your home, preserving funds for a child’s education, or maintaining a financial cushion for your spouse, careful estate planning ensures that your family members receive their intended inheritance. By minimizing the impact of long-term care expenses and Medicaid recovery, you can protect your family’s financial well-being and uphold your legacy.

How Medicaid Recovery Works in Maryland

Medicaid recovery, also known as the Medicaid Estate Recovery Program (MERP), allows the state of Maryland to seek reimbursement for Medicaid benefits paid for long-term care. This recovery often targets assets in the decedent’s estate, including homes, savings, and other property.

Key Points About Medicaid Recovery

- Triggering Events: Medicaid recovery typically begins after the recipient’s death and may apply to individuals aged 55 or older who received long-term care benefits.

- Exemptions: Certain assets, such as those left to a surviving spouse or disabled child, may be exempt from recovery.

- Avoiding Recovery: Proper estate planning can shield your assets from Medicaid recovery by utilizing trusts and other legal strategies.

Strategies to Protect Your Estate

1. Create a Medicaid Asset Protection Trust (MAPT)

A Medicaid Asset Protection Trust is an irrevocable trust designed to help individuals qualify for Medicaid while preserving their assets for heirs. By transferring assets to a MAPT, they are no longer counted as part of your estate for Medicaid eligibility or recovery purposes.

2. Engage in Advanced Planning

Timing is critical in Medicaid planning due to the five-year “look-back” period. Transfers of assets within five years of applying for Medicaid may result in penalties. Start planning as early as possible to avoid complications.

3. Utilize Life Estate Deeds

A life estate deed allows you to retain the right to live in your home for the rest of your life while transferring ownership to your heirs. This strategy can help avoid Medicaid recovery while preserving your home for your family.

4. Spend Down Strategically

Spending down assets on allowable expenses, such as home improvements or prepaying funeral expenses, can help you qualify for Medicaid without losing assets unnecessarily.

5. Work with an Experienced Maryland Estate Attorney

Navigating Medicaid rules and estate planning strategies is complex. An experienced Maryland estate attorney can provide personalized advice, help you establish trusts, and ensure compliance with state and federal regulations.

Common Mistakes to Avoid in Long-Term Care Planning

Waiting Too Long

Delaying long-term care planning can lead to rushed decisions and reduced options. Begin planning early to protect your assets and secure your family’s future.

Relying on DIY Solutions

Online templates and DIY estate planning tools may not address the complexities of Maryland’s Medicaid laws. Professional legal guidance is essential.

Ignoring Medicaid’s Look-Back Period

Failing to account for the five-year look-back period can result in penalties that delay your Medicaid benefits. Proper planning helps you avoid costly mistakes.

Why You Need a Maryland Estate Attorney

Planning for long-term care and protecting your estate from Medicaid recovery involves intricate legal and financial considerations. A Maryland estate attorney understands state-specific laws and can help you:

- Navigate Medicaid Rules: Ensure compliance with eligibility and recovery regulations.

- Establish Trusts and Deeds: Implement legal tools to shield your assets.

- Update Your Plan: Adapt your estate plan as laws and circumstances change.

Working with an attorney provides peace of mind that your plan is comprehensive, legally sound, and tailored to your family’s needs.

Checklist for Preparing for Long-Term Care Planning

To effectively plan for long-term care and protect your estate, follow this step-by-step checklist:

Assess Your Current Situation

- Evaluate your health and potential future care needs.

- Review your financial assets, income, and liabilities.

- Identify existing insurance policies, such as long-term care insurance.

Understand Medicaid Rules

- Familiarize yourself with Maryland’s Medicaid eligibility requirements.

- Learn about the five-year look-back period for asset transfers.

- Research exemptions that may apply to your situation.

Develop an Estate Plan

- Work with an estate attorney to create or update a will.

- Consider establishing a Medicaid Asset Protection Trust (MAPT).

- Explore the use of life estate deeds for your property.

- Identify and document intended heirs and beneficiaries.

Plan for Asset Protection

- Create a strategy to preserve your assets, including savings, investments, and property.

- Use allowable expenses, such as home improvements, to spend down strategically.

- Prepay for funeral expenses to reduce future financial burdens.

Find a Maryland Estate Lawyer

- Consult with an experienced Maryland estate attorney.

- Work with financial advisors to align your investments with your estate plan.

- Coordinate with family members to ensure everyone understands your wishes.

Prepare for Long-Term Care Costs

- Explore options for long-term care insurance.

- Research the costs of local nursing homes, assisted living facilities, and in-home care.

- Set aside emergency funds for unexpected expenses.

- Review and Update Regularly

- Revisit your plan periodically to account for changes in laws or personal circumstances.

- Update your plan after major life events, such as marriage, the birth of a child, or the sale of property.

Conclusion

Planning for long-term care in Maryland is a critical step in safeguarding your financial future and protecting your family’s inheritance. By understanding Medicaid recovery and implementing strategies like trusts, life estate deeds, and advanced planning, you can effectively shield your assets from unnecessary loss. Starting early and working with an experienced Maryland estate attorney ensures that your plan complies with state regulations and aligns with your family’s unique needs.

Contact Blackford & Flohr for Estate Planning Assistance

At Blackford & Flohr, we specialize in helping Maryland residents protect their assets and plan for long-term care. With decades of experience in estate planning and elder law, our attorneys provide personalized solutions to ensure your family’s financial future is secure. Call us at (410) 647-6677 or fill out our online contact form to get started.