Understanding the Legal Process for Declaring a Maryland Will Invalid

When a loved one passes away, it can be an emotional and challenging time. Things can become even more complicated if there are disputes about the validity of the deceased person’s will. In Maryland, there is a legal process in place for contesting a will, but it’s important to understand the steps involved, the grounds

Read More

The Role of Testamentary Trusts in Maryland Wills: Ensuring Future Financial Security

When planning for the future, many Maryland residents assume that a simple will is enough to ensure their loved ones are cared for. While wills are an essential part of estate planning, they do not always provide the structure and protection necessary for certain financial situations. That’s where testamentary trusts come in. What Is a

Read More

Understanding the Maryland Disclaimer of Interest Law

Estate planning in Maryland involves many legal tools and strategies to ensure assets are distributed according to one’s wishes. One such tool is the Disclaimer of Interest, which allows an individual to renounce their right to an inheritance or property interest. Understanding how this law works is essential for effective estate planning and asset protection.

Read More

The Process for Filing a Caveat to Contest a Will in Maryland

Contesting a will in Maryland involves a legal process known as a caveat proceeding. This process allows interested parties to challenge the validity of a will under specific circumstances. Understanding the steps and legal requirements is crucial for anyone considering such an action. What Is a Caveat Proceeding? A caveat proceeding is a formal objection

Read More

Understanding Payable on Death (POD) Accounts and Their Role in Maryland Estate Planning

What is a Payable on Death (POD) Account? A Payable on Death (POD) account is a financial account that allows the account holder to designate one or more beneficiaries who will receive the funds upon their death, bypassing probate. These accounts are commonly used for checking accounts, savings accounts, certificates of deposit (CDs), and money

Read More

How to Ensure Your Will Reflects Your Digital Legacy

Understanding Digital Assets and Their Importance A person’s online presence and assets have become just as important as physical and financial assets. From social media accounts and email to cryptocurrency and online businesses, your digital footprint holds significant value. Ensuring your will includes provisions for these assets is crucial to protecting your legacy and ensuring

Read More

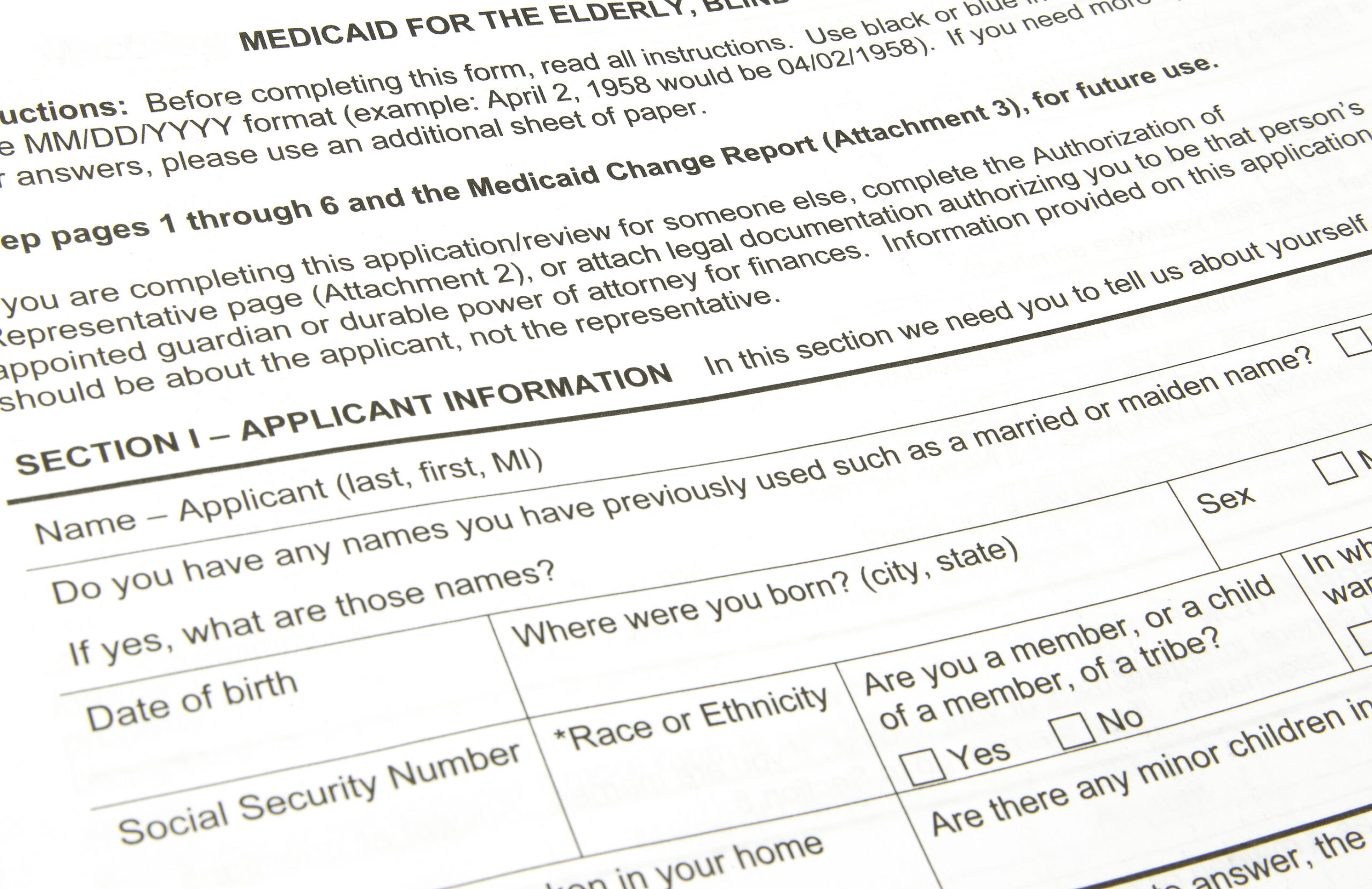

Planning for Long-Term Care in Maryland: Protecting Your Estate from Medicaid Recovery

Long-term care is an essential consideration for individuals and families in Maryland, especially as healthcare costs continue to rise. Planning ahead can help protect your assets from Medicaid recovery and ensure your estate is preserved for your loved ones. This guide will explain the basics of long-term care planning, how Medicaid recovery works, and why

Read More

How to Use a Qualified Terminable Interest Property (QTIP) Trust

When planning your estate, ensuring the financial security of your loved ones while maximizing tax benefits can be a complex challenge. A Qualified Terminable Interest Property (QTIP) Trust is a powerful tool for addressing these concerns, particularly for individuals in second marriages or with complex family dynamics. This guide explains what a QTIP trust is,

Read More

Handling Unclaimed Property in a Maryland Estate

Dealing with unclaimed property in a Maryland estate can be challenging. Whether it’s locating assets or navigating legal requirements, understanding the steps involved is crucial. Learn the essentials of handling unclaimed property in this post from Blackford & Flohr. What Is Unclaimed Property in an Estate? Unclaimed property in an estate typically refers to assets

Read More

How to Incorporate a Maryland Business Succession Plan into Your Estate Plan

For Maryland business owners, an estate plan is not just about distributing personal assets—it’s also about safeguarding the future of your business. Incorporating a business succession plan into your estate plan ensures a seamless transition of ownership and management, minimizes conflicts, and protects your legacy. In this post from Blackford & Flohr, we will walk

Read More